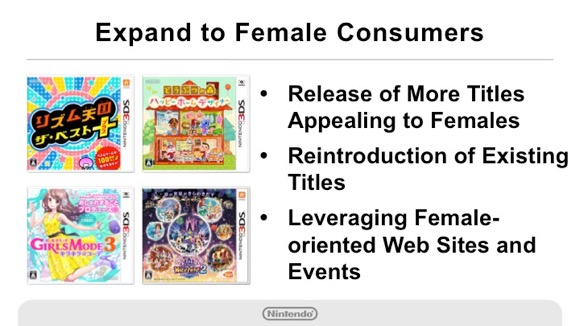

Three things: appealing further to girls and kids, keeping new titles coming and renewing interest in evergreen titles.

Three things: appealing further to girls and kids, keeping new titles coming and renewing interest in evergreen titles.

☆ NintendObs Event – Nintendo Q3 FY3/2016.

Let me begin with Nintendo 3DS.

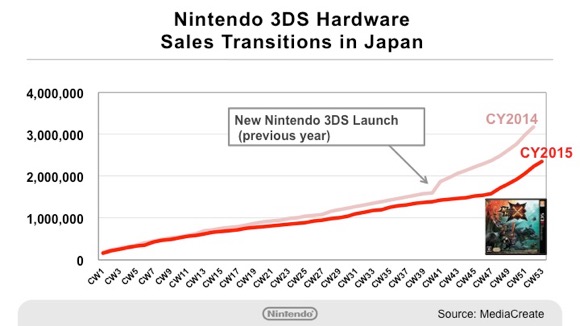

This graph shows the comparison between the Nintendo 3DS hardware sell-through numbers from 2014 (calendar year) and 2015 (calendar year) in the Japanese market.

In 2014, we were able to invigorate the market a little earlier than last year-end sales season with the launch of New Nintendo 3DS and the release of titles such as Super Smash Bros. for Nintendo 3DS and Pokémon Omega Ruby/Alpha Sapphire. On the other hand, in 2015, despite a little late start off compared to the previous year, we saw a hardware-driving effect of software such as CAPCOM CO LTD.’s Monster Hunter X (Cross), and there was momentum as strong as the previous year in the year-end sales season growth.

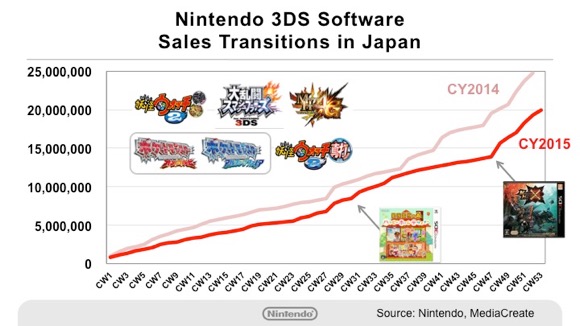

This graph shows the comparison between the Nintendo 3DS software sell-through numbers from 2014 and 2015 in the Japanese market.

In 2014, there was an unprecedented excitement in the market with the release of five titles that each sold over two million units in the six months from summer until the end of the year.

On the other hand, in 2015, although the total number of units sold is less than that of 2014 due to fewer popular titles, the momentum continued towards the end of the year, and sales figures grew steadily.

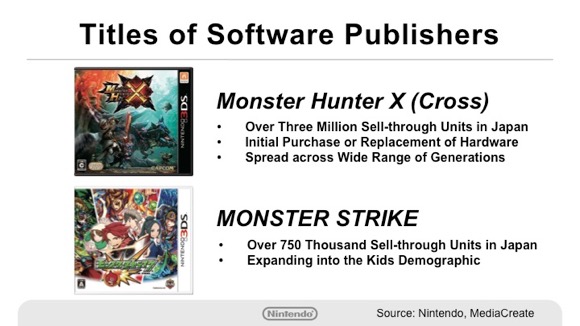

Regarding titles of software publishers, CAPCOM CO LTD’s Monster Hunter X (Cross) reached over three million units on a sell-through basis in the Japanese market. In addition to the units sold, Monster Hunter X (Cross) was played by an unexpectedly high number of males in their early teens in addition to longtime series fans, which was spurred by distributing a demo version of the title to explain the new appealing aspects of the game.

Also, mixi, Inc.’s MONSTER STRIKE has sold-through over 750 thousand units, and it was played widely among young consumers. We aim to propose “the next title to play” from our rich software lineup to these young consumers who started playing games with titles such as the ones mentioned here. In the end, we intend to increase the number of consumers who regularly enjoy playing games for many years to come.

We have repeatedly explained the importance of appealing to a wide generation of female consumers to bring more momentum to Nintendo 3DS in the Japanese market. Rhythm Tengoku (Japanese title) which was released in June last year, not only showed a steady rise of sales approaching the new year holiday season in the amount of over 700 thousand sell-through units to date in the Japanese market, but also showed that more than half of the consumers who played this title for the first time were female. Simultaneously, the percentage of kids 12 and under playing this title for the first time is also increasing.

In addition, Animal Crossing: Happy Home Designer, which sold through over 1.4 million units in the Japanese market and BANDAI NAMCO Entertainment Inc.’s DISNEY MAGIC CASTLE MY HAPPY LIFE 2 are also continuously selling well mainly among female consumers.

Through these activities, such as setting up a female-dedicated web site called “Nintendo 3DS for girls” and holding events at shopping malls and other facilities, we have feedback that indicates we were able to attract a wider generation of female consumers who previously had no interest in games.

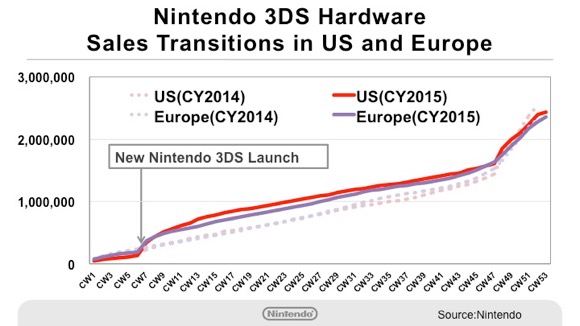

This graph shows the comparison between the Nintendo 3DS hardware sell-through numbers from 2014 and 2015 in the US and European markets.

Last year, the launch of New Nintendo 3DS in February and the price reduction of Nintendo 2DS worked positively so that we were able to maintain the strong momentum from the previous year.

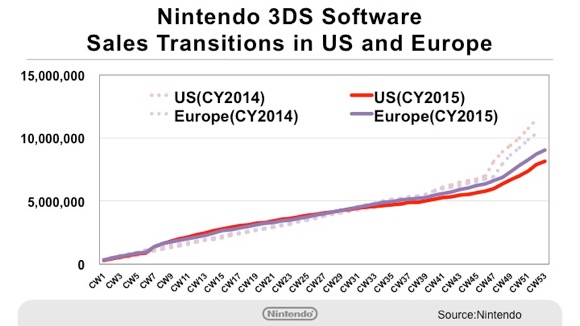

This graph shows the comparison between the Nintendo 3DS Nintendo-published software sell-through numbers from 2014 and 2015 in the US and European markets.

Sales did not reach that of 2014, in which Super Smash Bros. for Nintendo 3DS and Pokémon Omega Ruby/Alpha Sapphire were released in the year-end sales season. The difference between the figures of 2014 and 2015 for the European market shown in the purple lines is relatively small, and this was the result of comparatively strong sales of evergreen titles and “Nintendo Selects” titles which are sold at a reduced price, and the further popularization among female consumers.

We have said in the past that it is important in the overseas Nintendo 3DS business to increase sales by keeping a rich lineup of evergreen titles highly active rather than only relying on new titles.

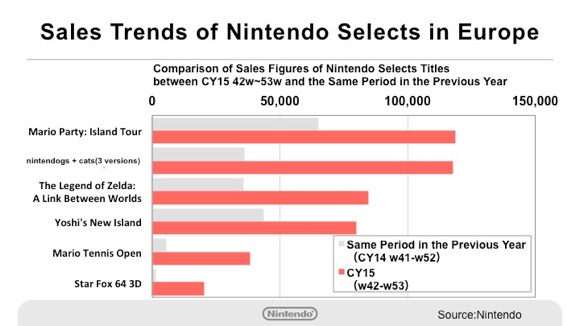

The red bars in this graph show the sell-through numbers of reduced-price titles called “Nintendo Selects,” which we sold in Europe starting in October last year.

Also, the gray bars represent the sell-through numbers of the same titles during the same period in the previous year, showing a comparison between the two figures.

Even after some time has passed since release, and sales have settled down, we were able to bring the momentum back to past titles by attracting consumers from a value perspective. In particular, both the sell-through numbers and the growth rate of nintendogs + cats were large, which seems to have been supported by many female consumers.

We will be encouraging our new female consumers to continue playing various titles by proposing selective titles from ones released in the past with an affordable price in the Japanese market as well.

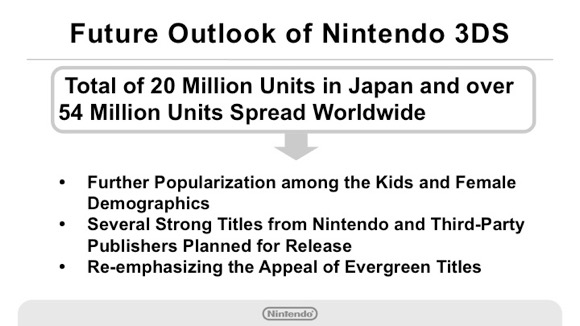

The total sell-through numbers of Nintendo 3DS hardware reached 20 million units in Japan and over 54 million units worldwide, providing sufficient grounds to make a profit in the software business.

As I explained regarding the expansion to kids and female demographics, we believe that there are still more titles in our existing rich lineup that have the potential to be played by consumers who were previously not interested depending on how we attract them. We will proactively consider marketing tactics such as “Nintendo Selects” that create a sense of urgency and motivate consumers once again to make a purchase.

Regarding hardware, just as Monster Hunter X (Cross) pushed consumers to purchase a New Nintendo 3DS system to replace their old Nintendo 3DS, we can anticipate that future strong titles can generate demand to replace old hardware with the new model. We are planning to keep on releasing new titles to help ensure they enjoy it over a long period of time.

We are also planning marketing tactics to invigorate the entire Nintendo 3DS business. On February 27, 2016, which is exactly 20 years from the release of Pokémon Red Version/Green Version for Game Boy on February 27, 1996, we will be launching special Pokémon bundles worldwide.

Four types of special edition Nintendo 2DS systems with Pokémon Red Version/Green Version/Blue Version/Yellow Version preinstalled will be launched in Japan.

On the same date, three types of special edition Nintendo 2DS systems with Pokémon Red Version/Blue Version/Yellow Version preinstalled will be launched in Europe, and a special edition New Nintendo 3DS system with Pokémon Red Version/Blue Version preinstalled which also comes with two types of cover plates will be launched in the US.

— Tatsumi Kimishima, President of Nintendo

Source: Nintendo JP, Nintendo JP.

At NintendObserver, the comments are on Discord.

Click on Community to learn more. 🙂

…

…Wanna play? Buy a 3DS.

And if you’ve already got yours, here are all the games already available on the platform. 😀