So Nintendo expects to outsell the five-year lifespan of the Wii U with Nintendo Switch within just about twelve months.

So Nintendo expects to outsell the five-year lifespan of the Wii U with Nintendo Switch within just about twelve months.

☆ NintendObs Event – Nintendo Q2 FY3/2018.

Thank you for making time to attend Nintendo’s financial briefing. I am Tatsumi Kimishima, President of Nintendo.

Mr. Furukawa, General Manager of the Corporate Planning Department, has just presented our financial results for this period.

Today I shall describe the progress made for the three objectives listed above.

Let’s begin with the progress for our smart-device business.

Details for the upcoming release of Animal Crossing: Pocket Camp, our Animal Crossing smart-device application, were released the other day. Please watch this promotional video that is available on the company’s official website.

Presentation (Animal Crossing: Pocket Camp Movie)

The Animal Crossing series allows players to enjoy living a carefree life with unique animal characters, in a virtual world where time passes as it does in our world. Although the series is fun for all genders, Animal Crossing is particularly popular within the Nintendo franchise among female consumers.

In Animal Crossing: Pocket Camp, you take the role of campground manager and interact with the animals as you catch fish or bugs. You also have the option to place various different pieces of furniture to make the campground more fun.

Distribution began on October 25 in Australia, and we are preparing to expand the release to a total of 41 countries worldwide. This title will be a free-to-start application that is free to download and start playing. There will be Leaf Tickets, which can be used in a variety of situations within the game, as consumable items. They will be available for free as the game advances but players can also purchase these. Our objective is to offer a service that allows even consumers who do not normally play games on a regular basis to have a little fun each and every day.

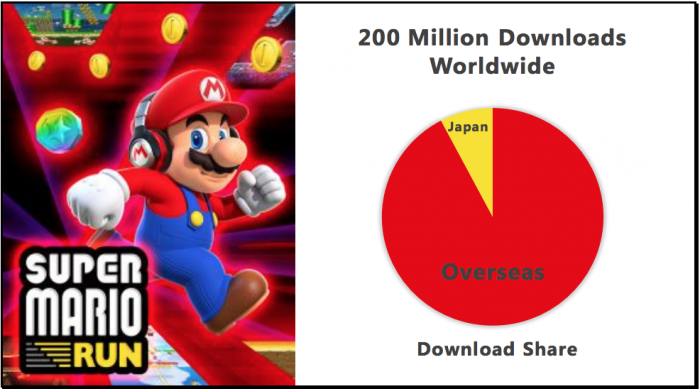

Super Mario Run has hit the 200 million mark for downloads. Overseas downloads comprise more than 90% of the total, and in spite of the difficulties in bringing a Japanese gaming application for smart devices to the global market, we were able to distribute a Mario game broadly, including to countries and regions not previously reached by our dedicated video game platform business.

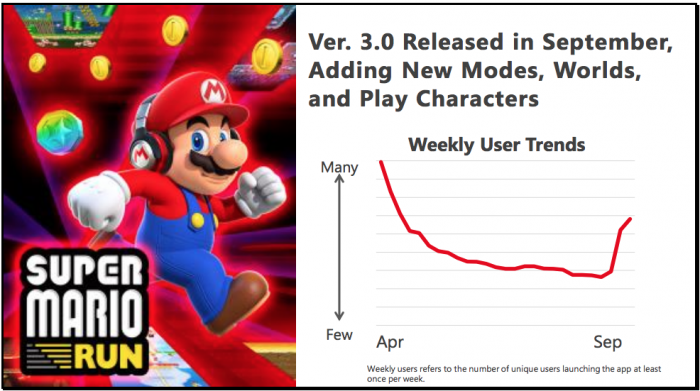

Our aim is for this application to be the definitive Mario application for smart devices. The major update to version 3.0 in September added, among other things, the new “Remix10” mode to allow for shorter bursts of thrilling play. Thankfully, it appears that “Remix10” and other updates have excited both consumers who have already purchased Super Mario Run as well as consumers who are downloading it for the first time. We also ran campaigns to foster more interest, including a special price offer for a limited period, to commemorate the release of the new version.

Although we have not yet reached an acceptable profit point, we have learned a lot in terms of game development and deployment that we want to take advantage of moving forward.

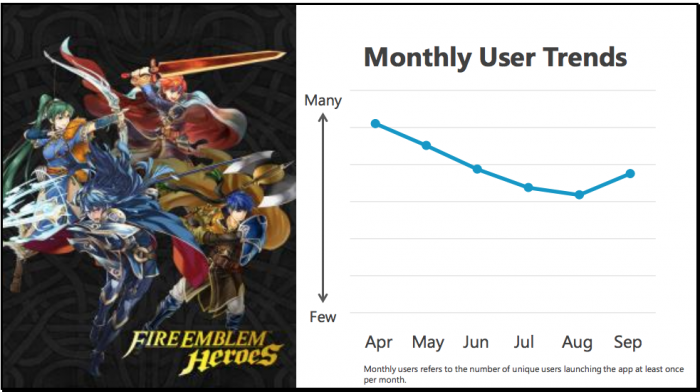

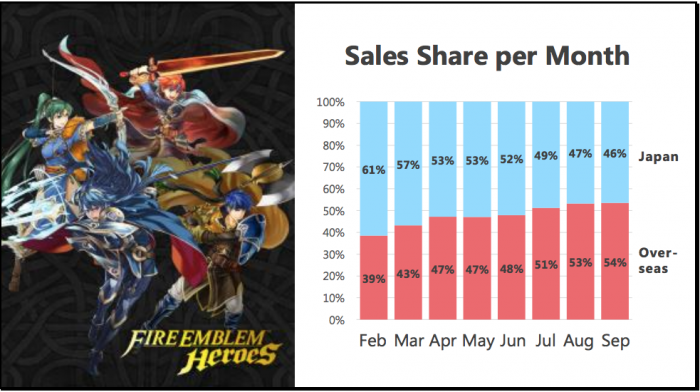

We will continue on to Fire Emblem Heroes, released in February of this year. For this title, we listened to the voices of our consumers and provided continual updates. As the result, we are on track to meet our overall business objectives, including our profit objectives. Since this summer, we have been holding large-scale events, adding new characters, adjusting specifications, and running new promotional campaigns, all bringing about another increase in active users.

You might think that the Fire Emblem series is more popular within Japan, but the share of sales overseas for Fire Emblem Heroes is steadily growing. As you can see, the overseas share of total sales has been expanding for the past several months and has exceeded sales in Japan. By the end of the year, we will also add support for Traditional Chinese text, and expand service to five new target countries and regions: Hong Kong, Taiwan, Macao, Thailand, and Singapore.

We will continue services for applications that have already been released, and we will continue releasing new smart device applications on the order of two to three per year.

Next, I will discuss the status of Nintendo 3DS.

New Nintendo 2DS XL, new hardware in the Nintendo 3DS family, launched in Japan, the US, and Europe in July.

Note: New Nintendo 2DS XL is called New Nintendo 2DS LL in Japan.

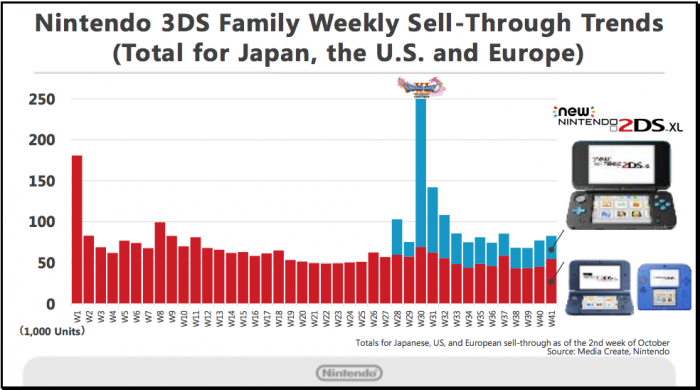

This graph shows the total Nintendo 3DS family weekly sell-through rates for Japan, the US, and Europe from the first week in 2017 to the second week of October. Even after the New Nintendo 2DS XL launch shown in blue, sales of other 3DS family hardware remained stable. Week 30 shows particularly high growth, and this spike was driven by the release in Japan of the Square Enix title Dragon Quest XI: Echoes of an Elusive Age.

Note 1: The other systems in the Nintendo 3DS family include New Nintendo 3DS, New Nintendo 3DS XL, Nintendo 3DS, Nintendo 3DS XL, and Nintendo 2DS.

Note 2: New Nintendo 3DS LL and Nintendo 3DS LL are sold outside of Japan as New Nintendo 3DS XL and Nintendo 3DS XL, respectively.

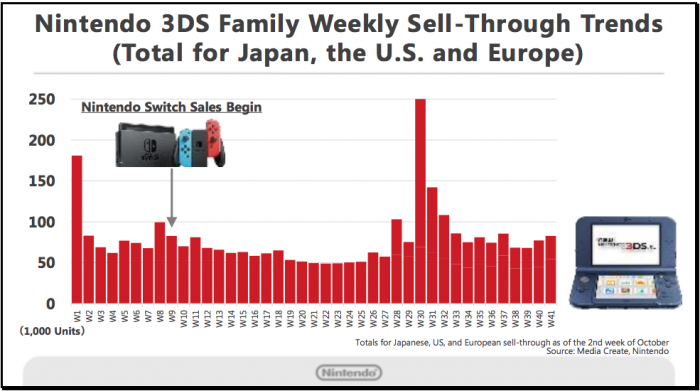

Even after Nintendo Switch sales began, sales of the Nintendo 3DS family remain stable, as you can see here.

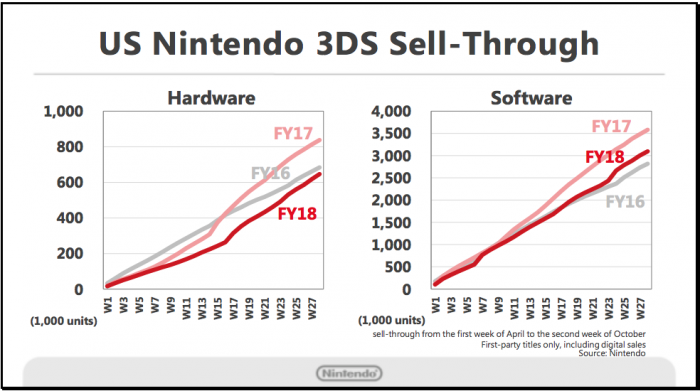

This graph shows Nintendo 3DS hardware and software sell-through rates in the US market from the first week of April 2017 through the second week of October in a year-on-year comparison for the past 2 years. The Pokémon series had a major impact on hardware and software sales in FY2017, resulting in a year-on-year decline in sell-through for FY2018.

Note: FY = Fiscal year (April through March of the following year)

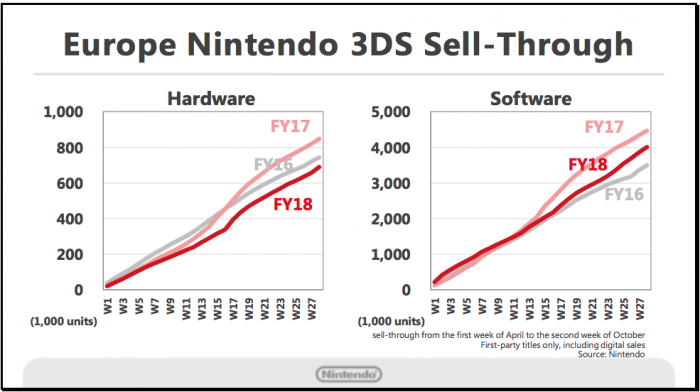

This graph shows Nintendo 3DS hardware and software sell-through trends for the European market. Although the figures for FY2018 are not as good for those of previous years, they are still firm overall.

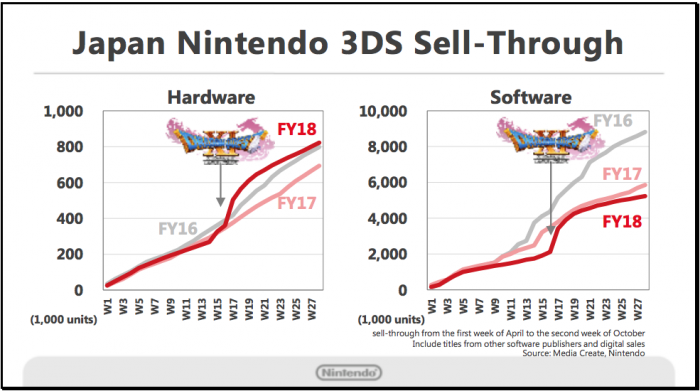

These are the figures for the Japanese market. For this graph alone, we include titles from other software publishers in the sales figures for software. In the domestic Japanese market, Dragon Quest XI: Echoes of an Elusive Age helped drive hardware sell-through upwards year-on-year.

Nintendo 3DS sales in each region for both hardware and software have experienced no significant drop-offs, as shown above, and maintain the positive momentum we expected.

We expect to reach the 70 million unit mark for cumulative series sell-in numbers for the Nintendo 3DS family soon. We will continue to work to make sure our business leverages this installed base this holiday season.

We have continued to introduce software titles to maintain the Nintendo 3DS business momentum. As you can see, multiple titles, including download-only titles, were released in September, well in advance of the holiday season.

Note: Fire Emblem Warriors will be released overseas in October.

From October onward, additional new titles include Mario & Luigi: Superstar Saga + Bowser’s Minions, Nintendo Presents: New Style Boutique 3 – Styling Star, Kirby Battle Royale, and Mario Party The Top 100.

Note: There may be difference in the release titles and timing, depending on the region.

The latest entries in the Pokémon series will be released in November as well.

We’re striving to maximize our business as we head into the holiday season with a wonderful combination of evergreen titles and new titles.

There will also be new color options and specially designed hardware for New Nintendo 2DS XL, expanding consumer choices.

Note 1: The black and lime, and white and lavender color combinations, as well as the Pikachu special edition, have been announced for sale within Japan.

Note 2: The Pikachu special edition hardware will only be sold at Pokémon Center stores.

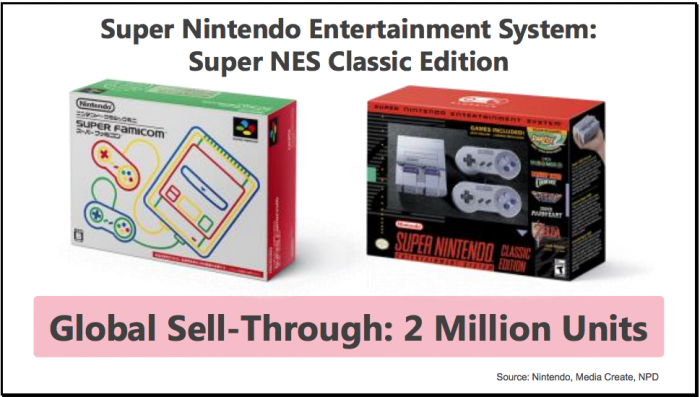

The palm-sized Super Nintendo Entertainment System: Super NES Classic Edition, a home console that recalls the nostalgia for Nintendo’s 1990s hardware, went on sale overseas in September, and in Japan in October.

Note: This hardware is called the Nintendo Classic Mini: Super Famicom in Japan and the Nintendo Classic Mini: Super Nintendo Entertainment System in Europe and Australia.

The Super Nintendo Entertainment System: Super NES Classic Edition has reached a sell-through of 2 million units worldwide, at latest tallies.

The expectation is that the chance to interact with video games for those who either haven’t done so in a long while or those who never have will lead to a greater appreciation for our newest gaming console, Nintendo Switch. The Super Nintendo Entertainment System: Super NES Classic Edition will continue to ship moving forward.

As has been announced already, a decision has been reached to resume production of the Nintendo Entertainment System: NES Classic Edition in 2018. We are hoping that consumers eager to purchase this system will wait just a short while longer.

Note: This hardware is called the Nintendo Classic Mini: Family Computer in Japan and the Nintendo Classic Mini: Nintendo Entertainment System in Europe and Australia.

I will end with a discussion of the progress made for the Nintendo Switch business effort.

Nintendo Switch is a new proposition: an in-home console hardware video game system that you can take with you. Once sales began, consumers the world over took that proposition to heart, with worldwide sales exceeding our initial forecasts. Product shortages have continued throughout the world because consumer demand has exceeded our hardware production capacity.

The Nintendo Switch “Anytime – Anywhere – With Anyone” play style concept has captured the interest of many different consumer demographics.

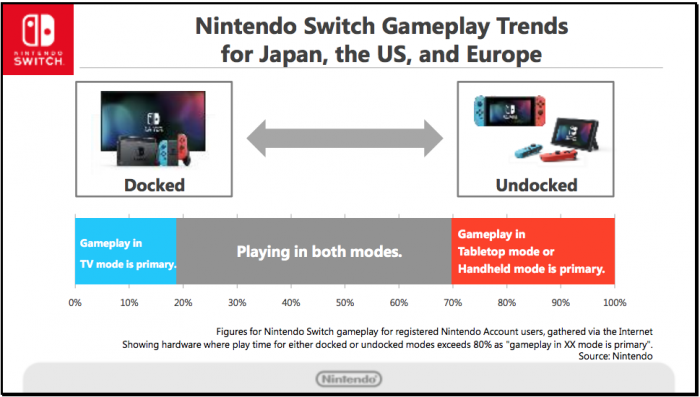

This indicates the Nintendo Switch gameplay trends. This chart is based on the figures for Nintendo Switch gameplay for registered Nintendo Account users, gathered via the Internet. There are three different Nintendo Switch play modes: TV Mode, where Nintendo Switch is docked and play occurs on a TV screen, and Tabletop Mode and Handheld Mode, where Nintendo Switch is removed from the dock. As the graph breaks it down, we can see how the different play modes for hardware use are classified, from the docked to the undocked experience. We can clearly see that consumers are playing to suit their own play styles.

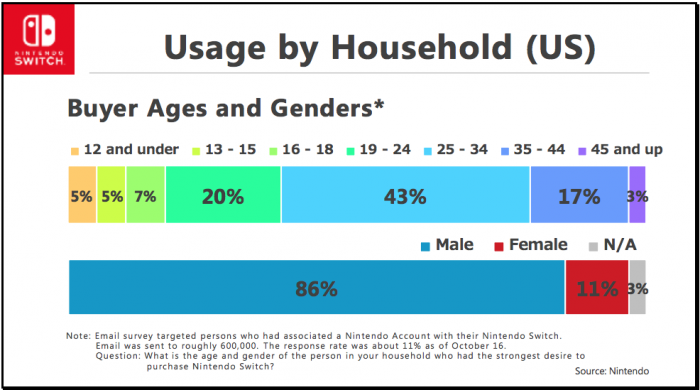

Here is some information on who is purchasing Nintendo Switch. These are the results of an Internet survey that was given to consumers in the US market in October who had linked a Nintendo Account to their Nintendo Switch system. Please keep in mind that these figures are only for the US market. As you can see, purchases are primarily made by male consumers in their 20s and early 30s. The results also show good interest among consumers in the 10 to 19 age range. This lets us look forward to future growth in our consumer base.

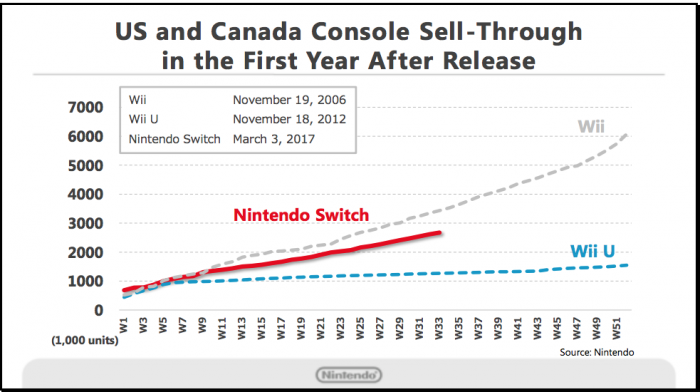

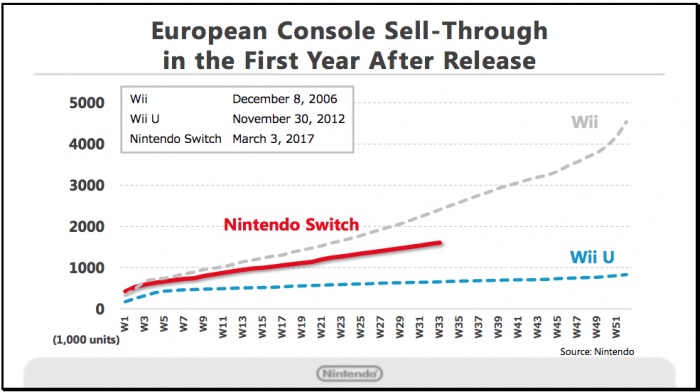

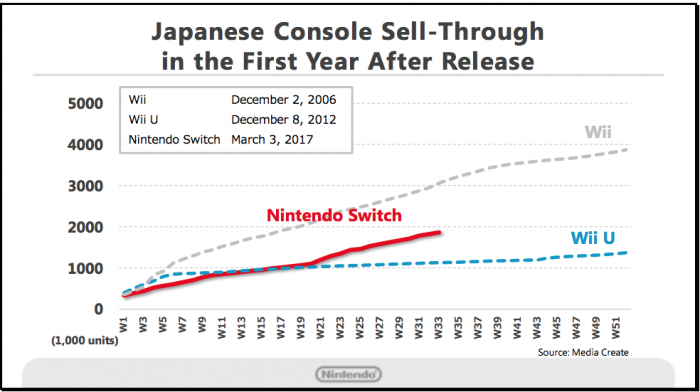

Let’s review the Nintendo Switch sales figures for the Japanese, US, and European markets.

This graph shows post-release Nintendo Switch sell-through trends for the North American market. The above shows an overlay of sell-through figures together with Wii and Wii U data for the first years after release. While Wii and Wii U were released during the holiday season, it’s important to note that the Nintendo Switch launch was timed completely differently, in March. It now looks like holiday season sales for Nintendo Switch could catch up to the Wii figures.

These are the figures for the European market. Similarly for the European market, sales figures are tracking to those for Wii.

This graph shows sell-through trends for the Japanese market. The sell-through rates are clearly growing in Japan as well.

We ended up with Nintendo Switch product shortages after worldwide demand exceeded our anticipated numbers. We might have seen further sales growth if we were better prepared from the start.

Our message at the financial results briefing in April focused on expanding the energy from the launch of Nintendo Switch and on the importance of maintaining its buzz throughout the year ahead, to maximize the installed base. Two new Nintendo titles went on sale in March at the same time as the Nintendo Switch launch, The Legend of Zelda: Breath of the Wild and 1-2-Switch. This was followed by the April release of Mario Kart 8 Deluxe, then ARMS in June and Splatoon 2 in July, generating non-stop consecutive release with titles that let you have fun with groups of friends or acquaintances. Our goal was to further promote longer play on Nintendo Switch.

During that same period, several software publishers were able to offer an impressive lineup of titles. From our consumers’ perspectives, the sense was that there were many titles available early on that could help cement a decision to buy our hardware.

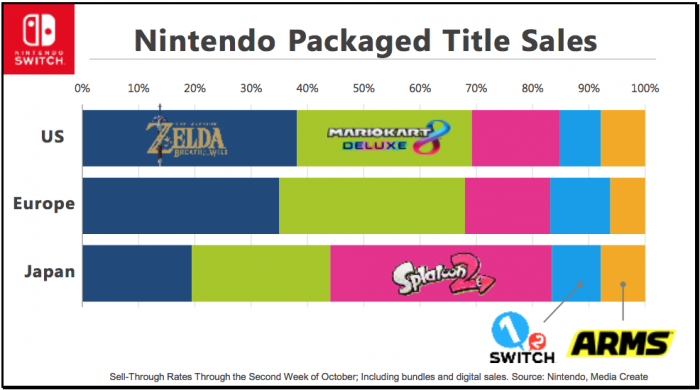

This graph shows a regional breakdown of sell-through rates for five Nintendo titles. For Japan, the most impressive performer to date has been Splatoon 2. For Europe and the US, it has been The Legend of Zelda: Breath of the Wild. Worldwide, it has been Mario Kart 8 Deluxe with a strong selling. Each region shows different trends, but that said, we can see that no single title is monopolizing the market in any region.

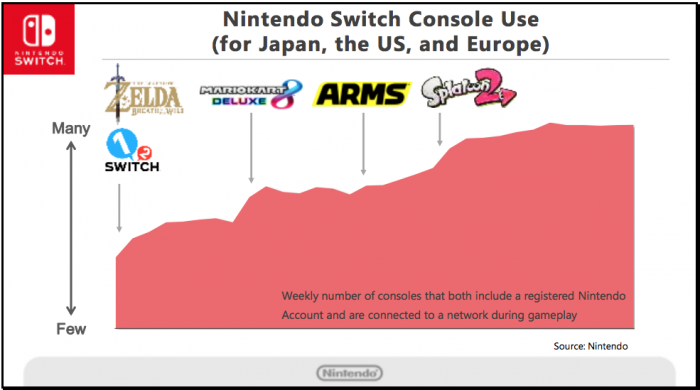

This graph shows the trends for Nintendo Switch console use. We can see that our consumers are actually playing their Nintendo Switch once they have it. The continuous release of titles has led to increasing hardware use, without any significant fall-offs.

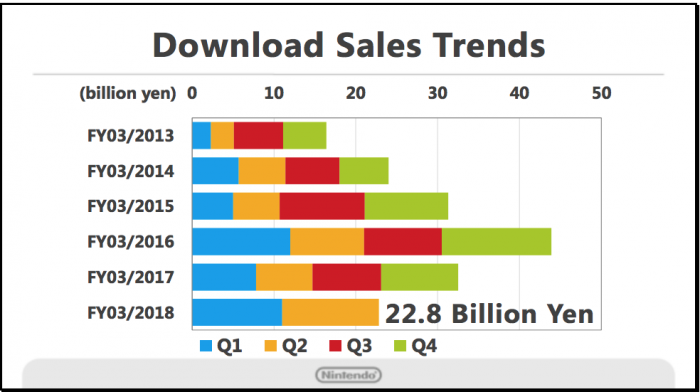

I would also like to touch on the progress we have made for our download sales. This figure shows the download sales of digital content for dedicated video game platforms compared to past years. Sales through the second quarter were the highest in our history for a six-month period. Download sales for Nintendo Switch highly contribute to increase of total download sales.

Note: FY = Fiscal year (April through March of the following year)

The first holiday season for Nintendo Switch will be here soon. Sales began for Nintendo Switch in March, which is not the usual sales season. Our challenge, as we head into the year’s end, will be in our ability to gain the support of a wide range of consumers.

We are expanding our production structure to meet domestic and overseas demand, which has exceeded our initial projections. We have worked hard to ensure that we can provide as many consoles as possible. There was an announcement yesterday that we will revise our hardware sales projections for this fiscal year to 14 million units.

The ongoing lack of Nintendo Switch hardware on shelves in domestic and overseas markets means that our consumers, eager to play the software that has already been released, are not yet fully able to acquire the hardware. We are working to ensure that these consumers are able to get hardware, moving forward. We therefore believe that already-released titles offer big opportunities for us during this upcoming holiday season and beyond, and will support a long tail for hardware sales.

This winter, there will be a second major release of paid downloadable content for The Legend of Zelda: Breath of the Wild, as well as the release of amiibo for the Four Heroes, as shown on this slide. There will also be a new packaged version for Snipperclips: Cut It Out, Together!, which has been only available as a download to date, that includes new stages and features. The ongoing free updates for ARMS and Splatoon 2 are part of our commitment to ensure consumers will keep playing, even for just one title. These efforts will generate buzz for released titles as well, and we believe it will help convince new consumers to make purchases.

Note: Consumers who have already purchased and downloaded Snipperclips: Cut It Out, Together! will be able to purchase add-on content for the new material.

In addition, December will also see the worldwide release of a new Nintendo title: Xenoblade Chronicles 2.

Furthermore, last Friday saw the release of Super Mario Odyssey in Japan and in overseas markets. This newest title in the Super Mario series received many awards this year at the largest game shows in Western markets, such as E3 and gamescom, and consumers had high expectations leading to its release. Although Super Mario Odyssey launched just a few days ago, the game appears to be meeting those expectations, judging by its high review scores from the gaming media and players’ positive comments on social media.

While about 7 million units of Nintendo Switch hardware have been delivered into the hands of our consumers around the world, we estimate that the global sell-through of Super Mario Odyssey has already exceeded 2 million units in just its first 3 days. The holiday sales season will soon go into full swing, and we plan to make more Nintendo Switch systems available in the market. We will endeavor to further increase the number of consumers who want to purchase Super Mario Odyssey, and eventually we would like the game to be seen as an evergreen title that has longevity in the market beyond this holiday season.

By releasing this product against a backdrop of maintained and growing buzz around Nintendo Switch, which also has continually high usage rates, we think this will give us a big edge heading into the holiday season.

Nintendo Switch has not been on the market for long, but we already have a lot of software publishers who see Nintendo Switch as an opportunity to expand their business moving forward. More than 300 software publishers at present, including indie developers, have begun developing game titles.

This is just some of the lineup that has been announced. As you can see, the wide variety of genres among the titles will further increase interest for Nintendo Switch. Having a broader consumer base will make it even easier for software publishers to do business. We are also continuing our work to establish a collaborative framework that facilitates the creation of more successful titles for our software publisher partners.

Based on the data at hand, we can see that the growth of our appeal among children and female consumers is beginning, more so for the Japanese market than for the US and European markets. Looking at intent to purchase among consumers who have not yet bought Nintendo Switch, there are indications that purchase intent is trending upward not only among children and families in their 30s but also among junior and senior high school students, and consumers in their 20s, of both genders. Nintendo is going to continue to work hard to expand our consumer base, among families and game fans as well, to increase purchases.

We anticipate a 14 million sell-in figure for Nintendo Switch in FY3/18. The sell-in figures for March of 2017 were at 2.7 million, but plans are for the sell-in figure to meet or exceed 16 million within the first year since the Nintendo Switch launch in March of 2017.

Without being overly optimistic, it is fair to say that everyone at Nintendo is involved in meeting those objectives and ensuring a steady installed base for Nintendo Switch.

This concludes our presentation.

Thank you very much.

— Tatsumi Kimishima, President of Nintendo

Source: Nintendo JP.

At NintendObserver, the comments are on Discord.

Click on Community to learn more. 🙂

…

…Wanna play? Buy a Switch.

And if you’ve already got yours, here are all the games already available on the platform. 😀